legal disclaimer 1 by June 3, 2024.

Configure your watch your way – choose your case size, colour and band. legal disclaimer *

Carbon-neutral case and band combinations available!

Offer Ends September 30, 2024. Conditions apply.

Open an eligible

RBC chequing account

and get iPad legal disclaimer 1

Configure your watch your way – choose your case size, colour and band. legal disclaimer *

Carbon-neutral case and band combinations available!

Offer Ends September 30, 2024. Conditions apply.

SPECIAL OFFER FOR FULL-TIME STUDENTS

Get $100 when you open a no monthly fee RBC Advantage Banking account for students legal disclaimer 1

Conditions apply. Offer ends October 31, 2024.

SPECIAL OFFER FOR FULL TIME STUDENTS

Get $100 when you open a no monthly fee RBC Advantage Banking account for students legal disclaimer 1

** Up to $500,000 CAD (in total contributions).

Conditions apply. Offer ends October 31, 2024.

SPECIAL OFFER FOR FULL-TIME INTERNATIONAL STUDENTS

International Students, get no-monthly-fee banking legal disclaimer 1 when you open an RBC Advantage Banking account for students legal disclaimer #

Get up to 12% cash back with a new RBC Cash Back Mastercard legal disclaimer #

Limited Time Offer. Conditions apply.

SPECIAL OFFER FOR FULL-TIME INTERNATIONAL STUDENTS

International Students, get no-monthly-fee banking legal disclaimer 1 when you open an RBC Advantage Banking account for students legal disclaimer #

Get up to 12% cash back with a new RBC Cash Back Mastercard legal disclaimer #

Limited Time Offer. Conditions apply.

SPECIAL OFFER FOR NEWCOMERS TO CANADA

No-monthly-fee

banking for a Year with an RBC Advantage Banking Account legal disclaimer 1

Plus, get a credit limit of up to $15,000 legal disclaimer * with an eligible Credit Card with No Credit History Required legal disclaimer 18 . Limited time offer. Conditions apply legal disclaimer 19 .

Plus, get a credit limit of up to $15,000 with an eligible Credit Card with No Credit History Required.

Limited time offer

Conditions apply

SPECIAL OFFER FOR NEWCOMERS TO CANADA

No-monthly-fee banking for a Year with an RBC Advantage Banking Account legal disclaimer 1

Plus, get a credit limit of up to $15,000 with an eligible Credit Card with No Credit History Required. Limited time offer. Conditions apply.

Let us help you Find a Chequing Account

Let us help you Find a Chequing Account

How many purchases, withdrawals and bill payments do you make on average each month?

How many purchases, withdrawals and bill payments do you make on average each month?

Tip: Exclude Interac legal disclaimer ‡ eTransfer transactions legal disclaimer 1, legal disclaimer 2 , public transit purchases legal disclaimer 3 , and transfers between RBC accounts - they're free.

Less Than 12 12 or More Less Than 12 12 or MoreLet us help you Find a Chequing Account

Knowing more about you can help us offer you the right bank account. Choose the button that describes you best.

![]()

I'm New to RBC

![]()

I'm a Student

![]()

I'm New to Canada

![]()

Help Me Choose

Unlimited Debits & Even More

Competitive Interest

For Students Age 13+

Competitive Interest

For Students Age 13+

Competitive Interest

Unlimited Debits & More

Unlimited Debits & Even More

Unlimited Debits & Even More

Unlimited Debits & Even More

Competitive Interest

If you're not 100% satisfied within the first 4 months, we'll refund up to 3 months of monthly fees. legal disclaimer 10 That's our Right Account Guarantee.

![]()

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee. legal disclaimer 11

Your browser does not support the video tag.If you're not 100% satisfied within the first 4 months, we'll refund up to 3 months of monthly fees. legal disclaimer 9 That's our Right Account Guarantee.

![]()

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee. legal disclaimer 10

If you're not 100% satisfied within the first 4 months, we'll refund up to 3 months of monthly fees. legal disclaimer 8 That's our Right Account Guarantee.

![]()

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee. legal disclaimer 9

If you're not 100% satisfied within the first 4 months, we'll refund up to 3 months of monthly fees. legal disclaimer 11 That's our Right Account Guarantee.

![]()

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee. legal disclaimer 12

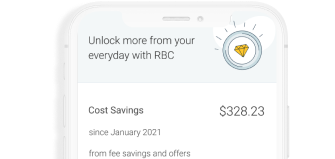

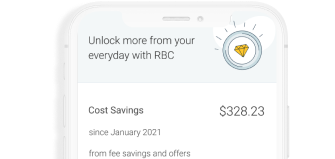

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account legal disclaimer 12 legal disclaimer 20 legal disclaimer 20 legal disclaimer 11 legal disclaimer 13 .

Only at RBC.

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases. legal disclaimer 13

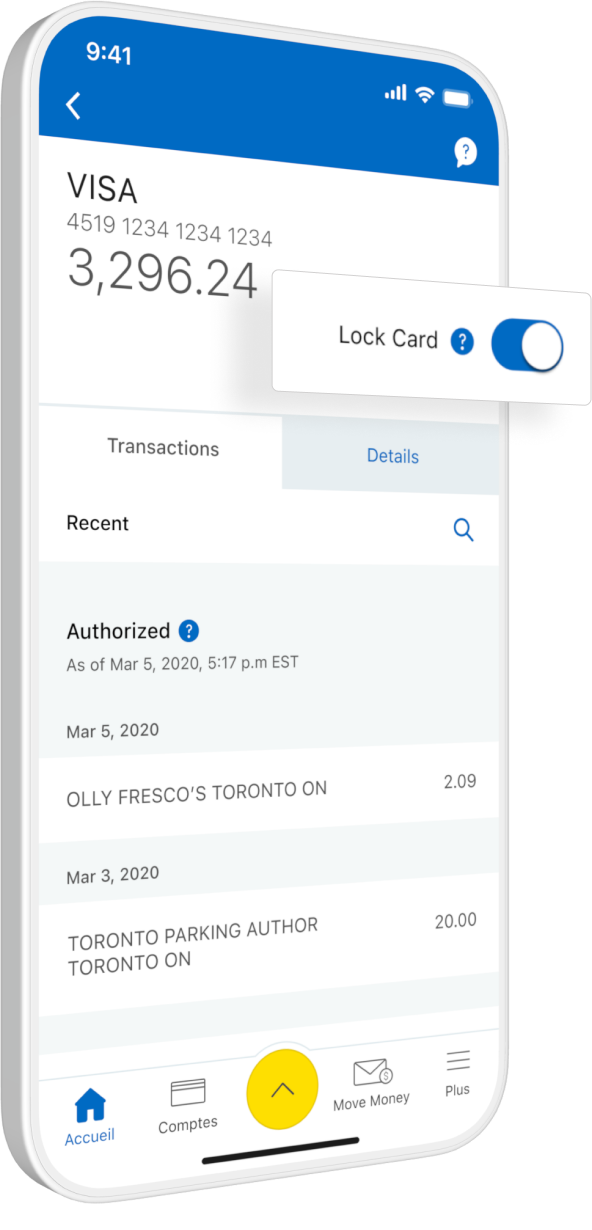

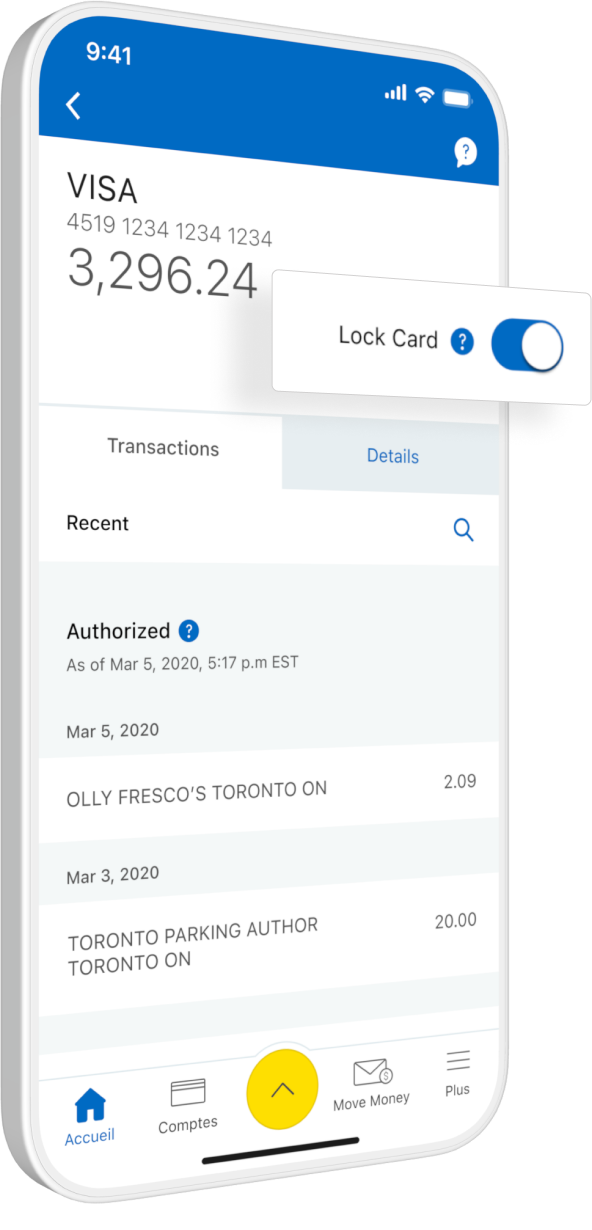

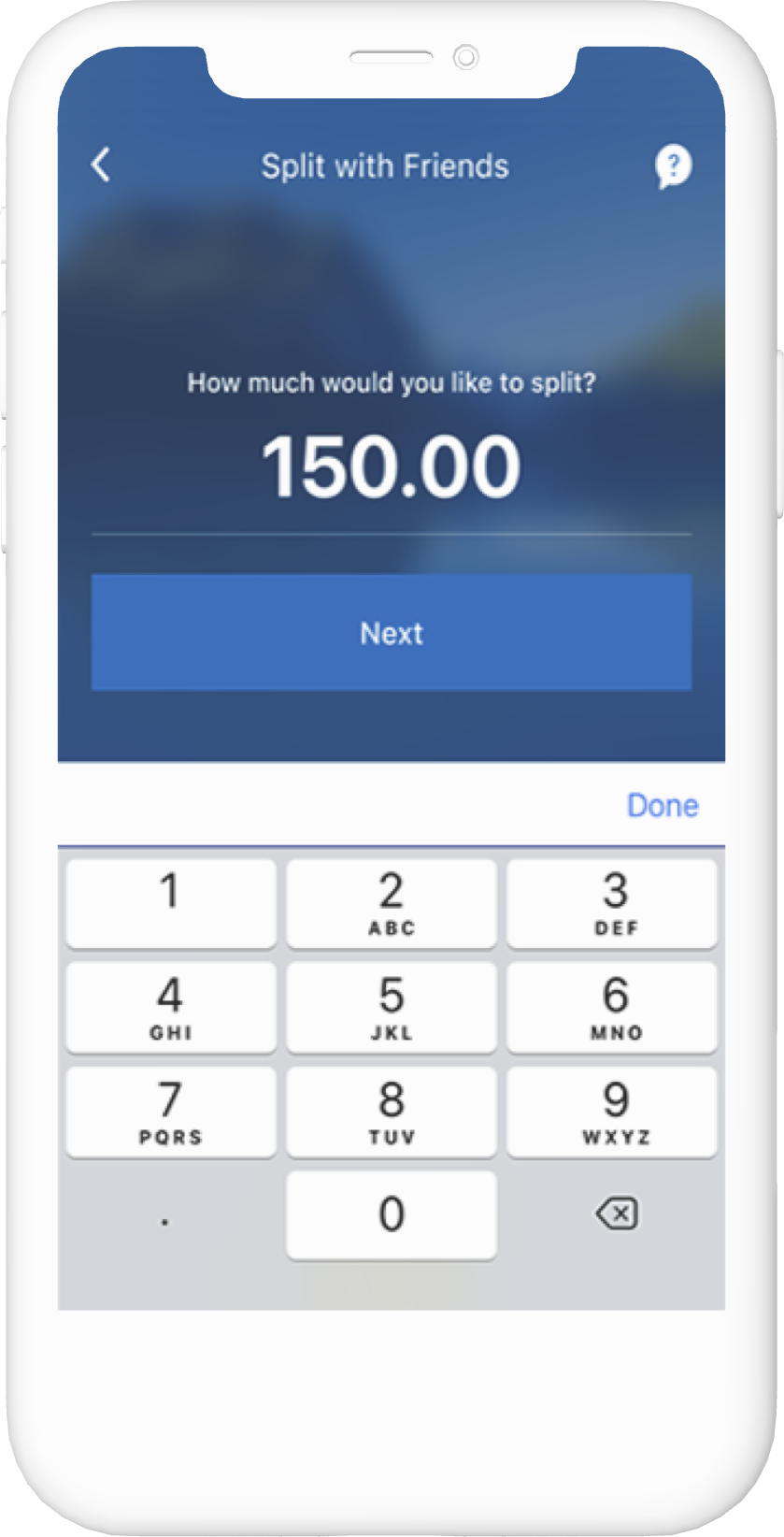

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 17 legal disclaimer 12 legal disclaimer 14 app. Unlock it just as fast.

Need some cash quick and you're not near an RBC ATM? Students pay no RBC fee to use another bank’s ATM in Canada.

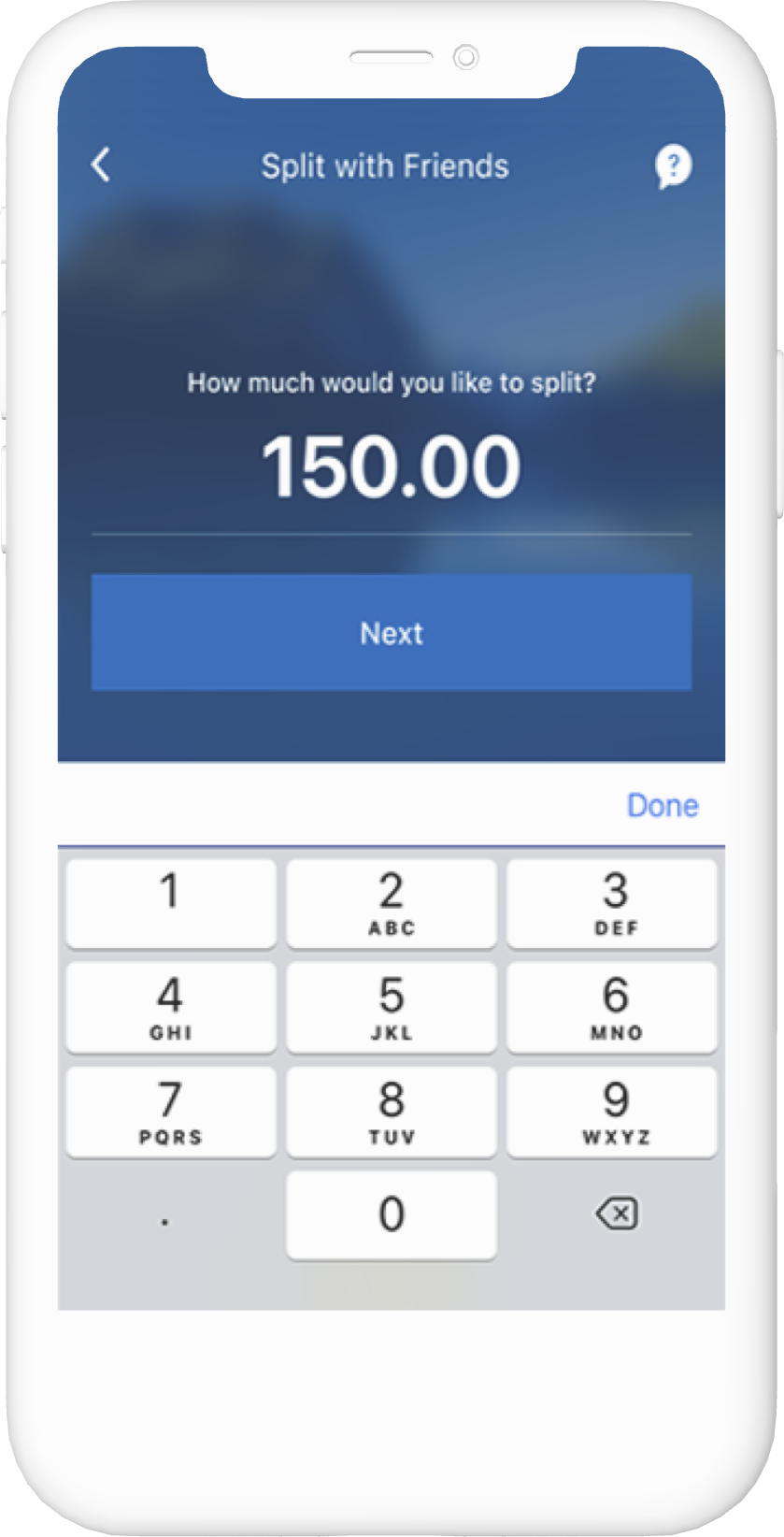

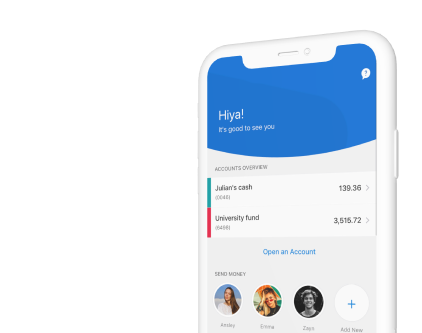

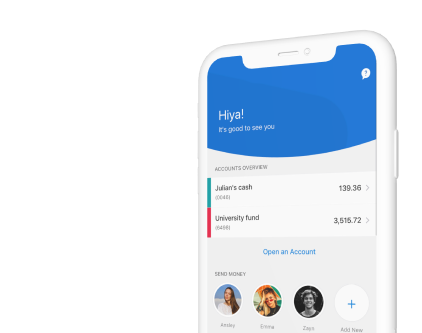

RBC Mobile Student Edition legal disclaimer 12 gives you access to the features that students use the most.

Load available offers to your eligible RBC debit card and get rewarded with personalized offers from popular brands. legal disclaimer 13

Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app. legal disclaimer 12

Need some cash quick and you're not near an RBC ATM? Students pay no RBC fee to use another bank’s ATM in Canada.

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases. legal disclaimer 13

Need some cash quick and you're not near an RBC ATM? Newcomers pay no RBC fee to use another bank’s ATM in Canada.

Newcomers with an eligible RBC chequing account get a book of 50 cheques for free.Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases. legal disclaimer 11

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases. legal disclaimer 14

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 17 legal disclaimer 12 legal disclaimer 14 app. Unlock it just as fast.

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account legal disclaimer 12 legal disclaimer 20 legal disclaimer 20 legal disclaimer 11 legal disclaimer 13 .

Only at RBC.

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases. legal disclaimer 13

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 17 legal disclaimer 12 legal disclaimer 14 app. Unlock it just as fast.

Need some cash quick and you're not near an RBC ATM? Students pay no RBC fee to use another bank’s ATM in Canada.

RBC Mobile Student Edition legal disclaimer 12 gives you access to the features that students use the most.

Load available offers to your eligible RBC debit card and get rewarded with personalized offers from popular brands.

Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app. legal disclaimer 12

Need some cash quick and you're not near an RBC ATM? Students pay no RBC fee to use another bank’s ATM in Canada.

Your browser does not support the video tag.Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases. legal disclaimer 13

Need some cash quick and you're not near an RBC ATM? Newcomers pay no RBC fee to use another bank’s ATM in Canada.

Newcomers with an eligible RBC chequing account get a book of 50 cheques for free. Your browser does not support the video tag.Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases. legal disclaimer 11

Now you can get rewarded for the things you do every day. Earn Avion points on your online and in-store debit purchases. legal disclaimer 14

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 17 legal disclaimer 12 legal disclaimer 14 app. Unlock it just as fast.

Pay as low as $0/month when you use your account and have other products. legal disclaimer 9 legal disclaimer 6 legal disclaimer 10

PersonalSave on your monthly fees when you enrol your account in the Value Program, have additional RBC products legal disclaimer 9 legal disclaimer 6 legal disclaimer 10 – like a credit card and an investment – and do simple activities such as direct deposit. Plus earn Avion points legal disclaimer 13 legal disclaimer 11 legal disclaimer 14 on your debit purchases, which can be combined with those earned on your Avion Rewards card. Redeem your Avion points to book flights, pay bills and save on everyday things like your favourite cup of coffee. When it comes to using your points, your options are nearly endless. The best part? Enjoy the Value Program at no additional cost.

Personal Credit Card Personal Investment Residential Mortgage Small Business AccountPay as low as $0/month when you use your account and have other products. legal disclaimer 9 legal disclaimer 6 legal disclaimer 10

Save on your monthly fees when you enrol your account in the Value Program, have additional RBC products legal disclaimer 9 legal disclaimer 6 legal disclaimer 10 – like a credit card and an investment – and do simple activities such as direct deposit. Plus earn Avion points legal disclaimer 13 legal disclaimer 11 legal disclaimer 14 on your debit purchases, which can be combined with those earned on your Avion Rewards card. Redeem your Avion points to book flights, pay bills and save on everyday things like your favourite cup of coffee. When it comes to using your points, your options are nearly endless. The best part? Enjoy the Value Program at no additional cost.

Load available offers to your eligible RBC debit card and get rewarded with personalized offers from popular brands. legal disclaimer 16

Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app. legal disclaimer 17 Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app. legal disclaimer 17

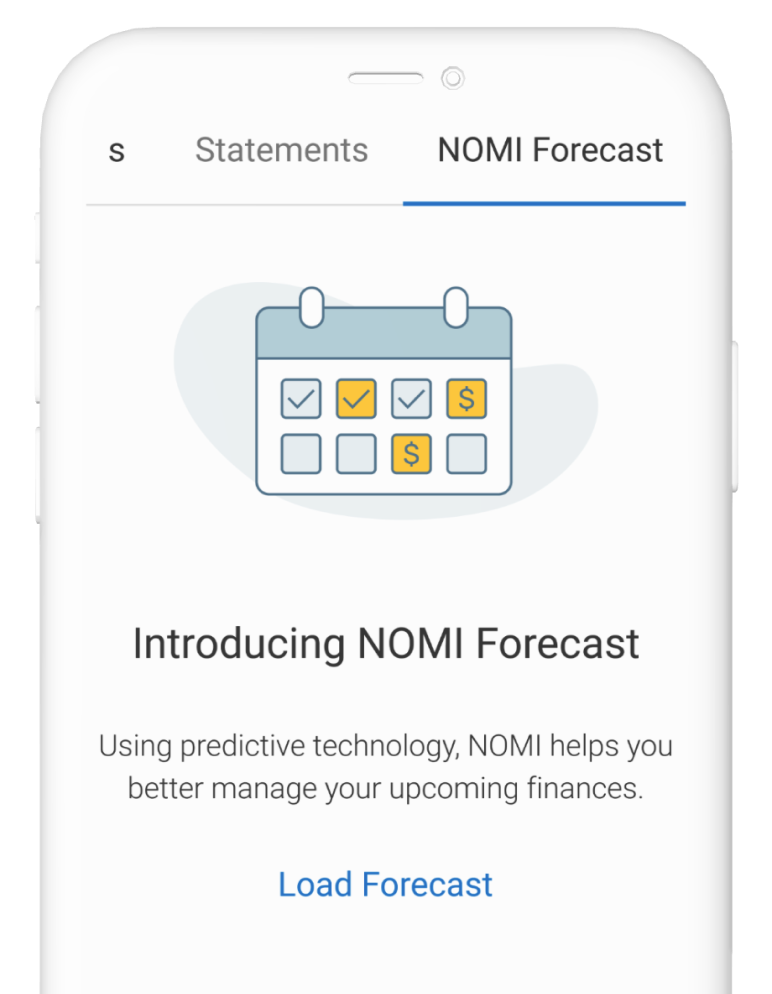

Providing a rolling forecast of your payments & deposits for the next 7 days, NOMI helps you stay on top of your money. legal disclaimer 18

Providing a rolling forecast of your payments & deposits for the next 7 days, NOMI helps you stay on top of your money. legal disclaimer 18

With Virtual Visa Debit legal disclaimer 14 , you can make secure online purchases using the money in your bank account.

With Virtual Visa Debit legal disclaimer 14 , you can make secure online purchases using the money in your bank account.

Load available offers to your eligible RBC debit card and get rewarded with personalized offers from popular brands. legal disclaimer 13

International students can get a credit limit of up to $2,000 with an eligible credit card and bank account – no credit history required! Conditions Apply Start Opening An Account

![]()

Full-time international students legal disclaimer 4 pay $0/month for RBC Advantage Banking for students.

Full-time international students legal disclaimer 4 pay $0/month for RBC Advantage Banking for students.

RBC Mobile Student Edition legal disclaimer 14 gives you access to the features that students use the most.

RBC Mobile Student Edition legal disclaimer 14 gives you access to the features that students use the most.

Newcomers to Canada can get a credit limit of up to $15,000 with an eligible credit card and bank account. Conditions Apply Open an Account

![]()

Newcomers to Canada pay no-monthly-fee for a year with an eligible RBC chequing account. legal disclaimer 1

Keep valuable items in a safe deposit box that's securely stored inside a vault at your local RBC Royal Bank branch. legal disclaimer 13

Load available offers to your eligible RBC debit card and get rewarded with personalized offers from popular brands. legal disclaimer 16

Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app. legal disclaimer 17 Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app. legal disclaimer 17

Providing a rolling forecast of your payments & deposits for the next 7 days, NOMI helps you stay on top of your money. legal disclaimer 18

Providing a rolling forecast of your payments & deposits for the next 7 days, NOMI helps you stay on top of your money. legal disclaimer 18

At RBC, we offer two types of personal bank accounts. Our chequing accounts are useful for your everyday banking—like paying bills and making purchases. Our savings accounts are ideal for money you don’t need to access every day. We also offer a range of business accounts.

Can I open multiple bank accounts?Yes, you can have more than one bank account at RBC—and you can also open an RBC bank account if you have an account at another financial institution. For example, many people complement the chequing account they use for their everyday banking needs with a savings account. Explore all bank accounts to see what’s right for you.

Can I open a bank account in the RBC Mobile app?Yes, new and existing RBC clients can open bank accounts in the RBC Mobile legal disclaimer 17 legal disclaimer 12 legal disclaimer 14 app within 5-10 minutes. If you are new to RBC, you’ll need:

If you would like to switch from one RBC bank account to a different RBC bank account that better fits your needs, visit a branch Opens in new window to talk to an advisor or call us at 1 800 769-2561 1 800 769-2561 (lines are open 24/7). Explore chequing accounts or savings accounts now.

What is RBC Vantage and how do I join?RBC Vantage is the way we describe all of the powerful benefits you can get just by having an eligible RBC bank account. There is no additional cost to enjoy these benefits—and you don’t need a minimum balance.

Here are just a few ways you can take advantage of these benefits:

I opened my personal bank account before the date on which the Value Program became available to the Canadian public. How do I determine whether the MultiProduct Rebate or Value Program is right for me?

Both programs offer a monthly fee rebate for having an eligible RBC bank account and other eligible RBC products. However, the Value Program also gives you the ability to earn Avion points legal disclaimer 13 legal disclaimer 15 legal disclaimer 11 legal disclaimer 14 when you use your enrolled account to make in-store and online debit purchases. The Value Program also offers more ways to earn a monthly fee rebate. legal disclaimer 9 legal disclaimer 16 legal disclaimer 15 legal disclaimer 6 legal disclaimer 10

If you currently have the MultiProduct Rebate legal disclaimer 19 legal disclaimer 18 legal disclaimer 17 on an account, but you do not complete at least 2 out of 3 regular account activities (a pre-authorized payment, direct deposit or bill payment) each month, the Value Program may not be the right fit for you.

For help deciding between the MultiProduct Rebate and the Value Program, please book an appointment with an RBC advisor. You can also call us at 1 800 769-2511 1 800 769-2511 or visit a branch Opens in new window .

Note: MultiProduct Rebate is only available to bank accounts opened prior to the date on which the Value Program became available to the Canadian public.

What do you need to open a bank account?To open an RBC bank account, you’ll need:

There is no minimum balance required to open an RBC bank account.

How long does it take to open a bank account?In most cases, you can open an RBC bank account online or in RBC Mobile legal disclaimer 17 legal disclaimer 12 legal disclaimer 14 app in approximately 10 minutes. You can also visit a branch Opens in new window to open your account.

Can I open a bank account online?Yes, you can apply to open most RBC bank accounts online or in the RBC Mobile legal disclaimer 17 legal disclaimer 12 legal disclaimer 14 app if you meet these requirements:

If you do not meet these requirements, please call 1 800 769-2561 1 800 769-2561 to book an appointment or visit a branch Opens in new window near you.

To be considered a full-time student, you must attend a primary or secondary school or be enrolled in a program at the post-secondary level at a college, university or other educational institution (whether in Canada or not). If you are a post-secondary student, you must take at least 60% of the usual course load for the program in which you are enrolled in any particular semester. Proof of enrollment may be requested at our discretion.

Can a non-resident open a bank account in Canada?Yes, non-residents living in Canada or planning to move to Canada can apply to open a Canadian bank account. Learn more about personal bank accounts for newcomers.

What is Avion Rewards?Avion Rewards gives you the opportunity to earn Avion points in many ways and the flexibility to redeem them for nearly endless options—travel the world, buy merchandise and gift cards from some of your favourite brands, pay down bills, invest in your future and much more.

There are several ways to earn points. For example, you can earn points when you make debit purchases with an eligible RBC bank account legal disclaimer 13 legal disclaimer 15 legal disclaimer 12 legal disclaimer 11 legal disclaimer 14 that is enrolled in the Value Program or when you make purchases with an Avion Rewards credit card.

Avion Rewards also gives you access to discounts, bonus points, special offers and savings you’ll only find at Canada’s largest bank-owned loyalty program.

Which bank accounts are eligible for the Value Program?The following RBC bank accounts are eligible to be enrolled in the Value Program:

View Legal Disclaimers Hide Legal Disclaimers

Legal Disclaimer 1)To take advantage of this offer, you must be a resident of Canada and age of majority by September 30, 2024 and you must not have an existing Personal Banking Account with Royal Bank of Canada or any of its deposit taking subsidiaries at the beginning of the “Promotional Period” on June 4, 2024, or in the prior five year period, and otherwise comply with the terms of the offer. You will be eligible to receive a complimentary Apple iPad (Apple 10th Generation Wi-Fi iPad 64GB, Model # MPQ03VC/A (Silver); MPQ13VC/A (Blue); MPQ23VC/A (Yellow); MPQ33VC/A (Pink)), when you open your first new Eligible Personal Banking Account of either an RBC Signature No Limit Banking ® account (monthly fee of $16.95) or RBC VIP Banking ® account (monthly fee of $30) by 9PM Eastern Time September 30, 2024 and complete two of the following ”Qualifying Criteria” by 9PM Eastern Time December 9, 2024: set up two pre-authorized payments from the Eligible Personal Banking Account; and/or one automated and recurring payroll or pension direct deposit to the Eligible Personal Banking Account, and/or two eligible bill payments to a service provider from the Eligible Personal Banking Account. RBC has the right to determine what is considered payroll. This offer may not be combined or used in conjunction with any other Personal Banking Account offers unless otherwise indicated. Royal Bank of Canada reserves the right to withdraw this offer at any time without notice, even after acceptance by you. Other conditions apply. For full details including defined terms visit www.rbc.com/ipadoffer.

legal disclaimer 2)As a sole or joint owner of an RBC Signature No Limit Banking (SNL) account and the primary cardholder of one of the eligible credit cards listed below, the annual fee of that eligible credit card will be fully or partially rebated (depending on the credit card you choose), every year, as long as your eligible card remains in good standing and you remain an SNL account owner. Additional cardholders (co-applicants and authorized users) do not qualify for the annual fee rebate, even if they are also owners of an SNL account. Only one credit card annual fee rebate per SNL account is allowed, which means that if you own a joint SNL account and each co-owner is also the primary cardholder of an eligible credit card, only the primary owner of the SNL account will be entitled to the credit card annual fee rebate. Other conditions and restrictions apply. Rebates that apply to eligible credit cards are: 1) $48 rebate (annual fee fully rebated) for: RBC ION+ Visa and WestJet RBC Mastercard card, or 2) $35 rebate (annual fee partially rebated) for: RBC Avion Visa Infinite Privilege, RBC Avion Visa Infinite, RBC Avion Visa Platinum, RBC Rewards Visa Preferred, RBC U.S. Dollar Visa Gold, RBC British Airways Visa Infinite, RBC Cathay Pacific Visa Platinum, RBC Cash Back Preferred World Elite Mastercard and WestJet RBC World Elite Mastercard. Royal Bank of Canada reserves the right to withdraw this offer at any time, even after acceptance by you.

legal disclaimer 3)There is a limit of 999 free Interac e-Transfer Transactions per Month per Account; for every Interac e-Transfer Transaction over the limit, you will be charged $1.

legal disclaimer 4)The standard Monthly Fee for the RBC Signature No Limit Banking account is $16.95; however, you may be eligible to receive a partial rebate on your account's standard Monthly Fee if you meet the criteria applicable to rebates or discounts we offer, as described herein, and in the document entitled Opens PDF in new window Personal Deposit Accounts Disclosures and Agreements.

legal disclaimer 5)The interest rate is an annual interest rate. It is a simple interest calculation. Interest is calculated daily on the closing credit balance and paid monthly. Interest rate is subject to change at any time without notice.

legal disclaimer 6) Fees may apply on the account from which the money has been transferred. legal disclaimer 7)Interac e-Transfer Transactions expire 30 days after they are sent and cannot be claimed by the recipient after this time. You have 15 days after the Interac e-Transfer Transaction is sent to cancel without charge. A $5 Interac e-Transfer Transaction Reclaim Fee is charged when a recipient does not accept it before it expires and the sender does not cancel the transaction before the 15-day cancellation period.

legal disclaimer 8)The Bonus Interest Rate of 3.90% within the RBC New eSavings Client Bonus Interest Rate Offer (“Offer”) is available to residents of Canada who are of the age of majority in the province or territory in which they reside as of the date the Eligible eSavings Account is opened and who were not the Primary Owner of an RBC High Interest eSavings Account at any time before the beginning of the Qualifying Period (as defined below), and who open a new RBC High Interest eSavings Account (“Eligible eSavings Account”) as the Primary Owner between August 1, 2024 and 3:00 PM EST on October 31, 2024 (the “Qualifying Period”). (Note: For added clarity, you will not qualify for this Offer by switching from another account type to an Eligible eSavings Account.) The Bonus Interest Rate on August 1, 2024 was 3.90% and is only applicable to deposits made in the Eligible eSavings Account for 3 months (90 days) from the date the Eligible eSavings Account was opened (the “Promotional Period”) and up to a maximum of $1,000,000 of the Eligible eSavings Account’s total balance. Any balances over $1,000,000 will be paid the Regular Interest Rate. “Promotional Interest Rate” is a combination of the Bonus Interest Rate plus the Regular Interest Rate. For example, if on August 1, 2024, the Regular Interest Rate was 1.50% per annum and the Bonus Interest Rate was 3.90% per annum, the Promotional Interest Rate would be 5.40% per annum. The Regular Interest Rate is subject to change without notice, and the most current rate is posted on our Personal Accounts Interest Rates webpage, which may be viewed at https://www.rbcroyalbank.com/rates/persacct.html. At the end of the Promotional Period, all balances will earn interest at the Regular Interest Rate only. Regular Interest Rate and Bonus Interest Rate are annualized rates, and (subject to certain exceptions) are calculated daily and paid monthly. Any Eligible eSavings Account that, prior to the payment of interest at the Bonus Interest Rate, is closed or switched to another product type which is not an RBC High Interest eSavings Account will forfeit any such interest calculated during the month in which the Eligible eSavings Account is closed or switched. Offer and interest rates are subject to change without notice. Offer may be withdrawn at any time. Conditions apply. For other defined terms and complete terms and conditions that apply to this Offer, please visit https://www.rbcroyalbank.com/investments/psi/august2024-hisa/terms.html.

legal disclaimer 9)By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Opens PDF in new window Value Program Terms & Conditions.

legal disclaimer 10)Eligible accounts include: RBC VIP Banking, RBC Signature No Limit Banking, RBC Advantage Banking, RBC Day to Day Banking account. You must close the account and apply for the refund or switch to another account within 4 months of account opening or upgrade. Offer limited to one account opening or upgrade per customer per calendar year. Offer may be withdrawn at any time without notice.

legal disclaimer 11)For full details regarding the protections and limitations of the RBC Digital Banking Security Guarantee, including your responsibilities in ensuring the safety and security of your transactions, please see your Electronic Access Agreement and your Opens PDF in new window Client Card Agreement for personal banking clients, and the Opens PDF in new window Master Client Agreement for business clients. This guarantee is given by Royal Bank of Canada in connection with its Online and Mobile Banking services. Formerly known as the RBC Online Banking Security Guarantee.

legal disclaimer 12)The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

legal disclaimer 13)When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Opens PDF in new window Value Program Terms & Conditions.

legal disclaimer 14)To participate in this offer, you must have an RBC debit or credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC business clients will only be able to link up to two (2) business credit cards and one business debit card to a Petro-Points card. You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A linked RBC Card means an RBC Card linked to a Petro-Points Account. Your linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your linked RBC Card at Petro-Canada locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your linked RBC Card. Each time you use your linked RBC Card to purchase any grade of gasoline, or diesel, at a Petro-Canada location, you will save three cents ($0.03) per litre at the time of the transaction.

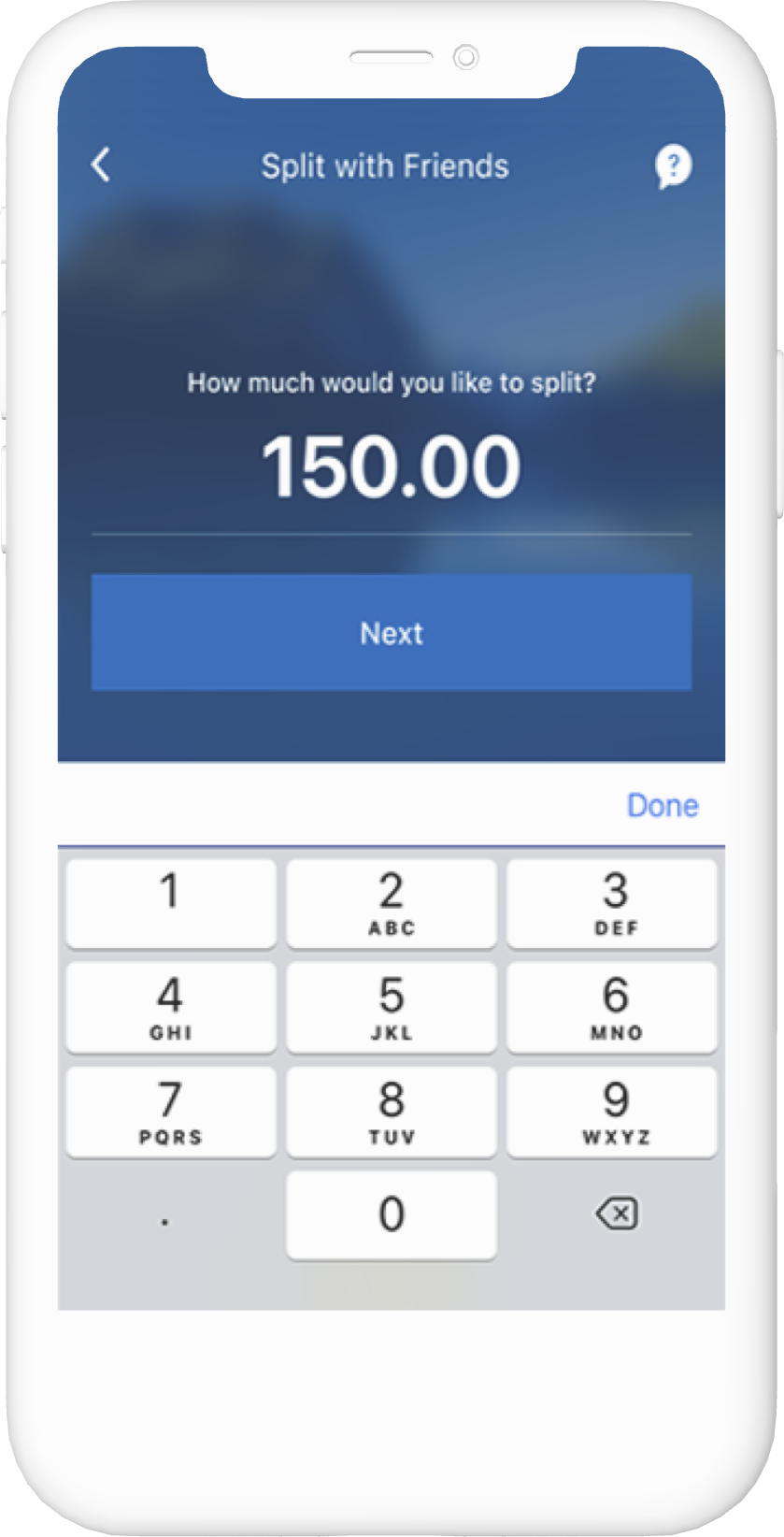

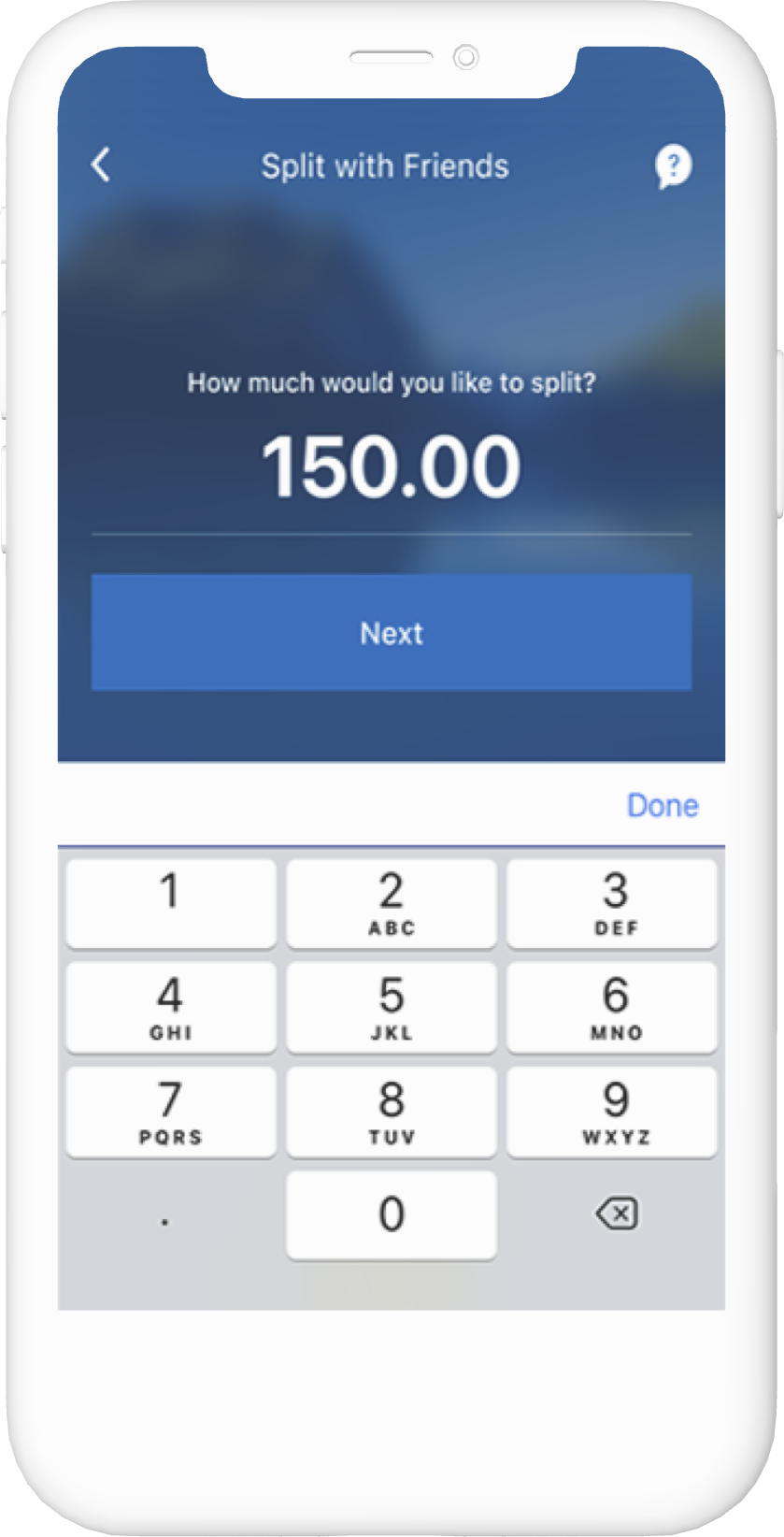

legal disclaimer 15)You can send up to 25 requests at a time up to $10,000 each to anyone banking in Canada with Request Money in the RBC Mobile app. Limits for fulfilling Request Money transactions vary by financial institution and recipient. Contact your recipient to ensure your request can be fulfilled. Any unfulfilled money request will expire after 30 calendar days.

legal disclaimer 16)The Offers program is available to clients with an RBC Royal Bank (i) debit card tied to a personal or business chequing account, and/or (ii) personal or business credit card, other than an RBC Commercial Visa or RBC US Dollar Visa card.

Eligibility criteria for an Offer: (a) is determined by RBC, (b) may vary depending on the offer, and (c) may be based on the client’s preferences and account status. Eligible clients will refer to the terms and conditions applicable to each specific Offer for more details.

legal disclaimer 17)RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc.

legal disclaimer 18)The NOMI Find & Save Service will transfer funds from your designated source account to your NOMI Find & Save Account. The source account must be an eligible Royal Bank of Canada Canadian personal chequing account.

legal disclaimer 19)If you have an eligible banking account and two or more qualifying, eligible RBC® products in the same geographic location (region), you may receive a partial or full rebate on your Monthly Fee. Conditions apply. For more information on the MultiProduct Rebate® visit any RBC Royal Bank branch, call 1 800 769-2511 1 800 769-2511 or view the full Disclosures and Agreements Booklet.

legal disclaimer 20)Total of 90 days: For the purpose of this RBC New eSavings Client Bonus Interest Rate Offer and any related marketing, any reference to a period of 3 months means a period of 90 calendar days regardless of how many calendar days may fall within any given calendar 3-month period.

legal disclaimer ® / ™Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada.

legal disclaimer ‡ All other trademarks are the property of their respective owner(s).View Legal Disclaimers Hide Legal Disclaimers

Legal Disclaimer 1)Offer available July 1, 2024 – October 31, 2024 (“Promotional Period”)

This Promotional offer is available to any Eligible Student Client without a Personal Banking Account with Royal Bank of Canada at the beginning of the Promotional Period or in the three-year period before the start of the Promotional Period, and who otherwise comply with the Terms of the Promotional offer. The Bonus Offer is $100 with an Eligible Personal Banking Account.

To qualify for the $100, you must open your first new Eligible Personal Banking Account by 9:00 PM EST on October 31, 2024, and complete one of the following Qualifying Criteria by 9:00 PM EST on December 27, 2024 using your Eligible Personal Banking Account:

i. a minimum of three (3) debit transactions;

ii. register your Eligible Personal Banking Account for Interac Autodeposit and make one (1) e-Transfer using RBC Online Banking or the RBC Mobile app; or

iii. enroll for a Virtual Visa Debit Card and make one (1) transaction.

NOTE: Qualifying Debit Transactions are defined as Bill Payments or purchase transaction using any of the following: your RBC Client Card, an RBC Virtual Visa Debit card associated with your Eligible Personal Banking Account, Interac Flash, Apple Pay, Google Pay, Samsung Pay. Transactions carried out at an RBC Royal Bank branch or through the RBC Royal Bank ATM network, and bank fee transactions, are not included as qualifying transactions

NOTE: You must be at least 14 years of age to obtain an RBC Virtual Visa Debit card. As such, option iii. (above) of this section is only available to individuals who meet this minimum age requirement; if you are below the age of 14 and participate in this Promotional Offer, you must select one of the other eligible transaction types described.

The $100 cash component of the Bonus Offer will be deposited into your Eligible Personal Banking Account within 2 to 8 weeks of completing the Qualifying Criteria, if applicable. Royal Bank of Canada may follow up with Eligible Student Clients to remind them to complete the Qualifying Criteria.

This offer may not be combined or used in conjunction with any other Personal Banking Account offers. Royal Bank of Canada reserves the right to withdraw this offer at any time without notice, even after acceptance by you. For full details including defined terms visit rbc.com/studentterms.

legal disclaimer 2)Subject to credit approval. If you are a post-secondary student and an owner or co-owner of an RBC Advantage™ Banking Account for students (“Eligible Student Bank Account”) and the primary cardholder of one of the eligible RBC Royal Bank credit cards listed below (each, an “Eligible Credit Card”), the annual fee of your Eligible Credit Card may be fully rebated, every year:

| Eligible Credit Cards | Annual Fee Rebate |

|---|---|

| RBC ION+ Visa | $4 a month ($48 annually) |

| WestJet RBC MasterCard | $39 |

| Signature RBC Rewards Visa | $39 |

| Visa Cash Back Card | $19 |

For any other RBC Royal Bank credit card, regular annual fees apply as they are not eligible for a rebate. For the annual fee of your Eligible Credit Card to be fully rebated, every year, you must: i) complete the Student Information section of the credit card application in full, ii) remain a student, and iii) be an owner or co-owner of an Eligible Student Bank Account throughout your studies. The annual fee of your Eligible Credit Card will continue to be fully rebated: i) until you close your Eligible Student Bank Account, or ii) until the Expected Graduation Year you have provided at the opening of your Eligible Student Bank Account, whichever comes first. Thereafter, the annual fee will no longer be rebated. If, for some reason, the Expected Graduation Year you have provided at the opening of your Eligible Student Bank Account differs from the one you have indicated on your credit card application, the Expected Graduation Year you have provided at the opening of your Eligible Student Bank Account will prevail and be used for determining the expiry of this offer. Additional cardholders (co-applicant and authorized user(s)) do not qualify for the annual fee rebate even if they are also owners of an Eligible Student Bank Account. Only one credit card annual fee rebate per Eligible Student Bank Account is allowed. If you already have an Eligible Student Bank Account, the rebate will be applied at the time you open your Eligible Credit Card account. If you open your Eligible Student Bank Account after you have opened your Eligible Credit Card account, the rebate will be applied at your next annual renewal and won't be applied retroactively. Other conditions and restrictions may apply. Royal Bank of Canada reserves the right to withdraw this offer at any time, even after acceptance by you.

legal disclaimer 3)There is a limit of 999 free Interac e-Transfer Transactions per Month per Account; for every Interac e-Transfer Transaction over the limit, you will be charged $1.

legal disclaimer 4)To be considered a full-time student, you must attend a primary or secondary school OR be enrolled in a program at the post-secondary level at a college, university or other educational institution (whether in Canada or not). If you are a post-secondary student, you must take at least 60% of the usual course load for the program in which you are enrolled in any particular semester. Proof of enrollment may be requested at our discretion.

legal disclaimer 5)The interest rate is an annual interest rate. It is a simple interest calculation. Interest is calculated daily on the closing credit balance and paid monthly. Interest rate is subject to change at any time without notice.

legal disclaimer 6) Fees may apply on the account from which the money has been transferred. legal disclaimer 7)Interac e-Transfer Transactions expire 30 days after they are sent and cannot be claimed by the recipient after this time. You have 15 days after the Interac e-Transfer Transaction is sent to cancel without charge. A $5 Interac e-Transfer Transaction Reclaim Fee is charged when a recipient does not accept it before it expires and the sender does not cancel the transaction before the 15-day cancellation period.

legal disclaimer 8)The Bonus Interest Rate of 3.90% within the RBC New eSavings Client Bonus Interest Rate Offer (“Offer”) is available to residents of Canada who are of the age of majority in the province or territory in which they reside as of the date the Eligible eSavings Account is opened and who were not the Primary Owner of an RBC High Interest eSavings Account at any time before the beginning of the Qualifying Period (as defined below), and who open a new RBC High Interest eSavings Account (“Eligible eSavings Account”) as the Primary Owner between August 1, 2024 and 3:00 PM EST on October 31, 2024 (the “Qualifying Period”). (Note: For added clarity, you will not qualify for this Offer by switching from another account type to an Eligible eSavings Account.) The Bonus Interest Rate on August 1, 2024 was 3.90% and is only applicable to deposits made in the Eligible eSavings Account for 3 months (90 days) from the date the Eligible eSavings Account was opened (the “Promotional Period”) and up to a maximum of $1,000,000 of the Eligible eSavings Account’s total balance. Any balances over $1,000,000 will be paid the Regular Interest Rate. “Promotional Interest Rate” is a combination of the Bonus Interest Rate plus the Regular Interest Rate. For example, if on August 1, 2024, the Regular Interest Rate was 1.50% per annum and the Bonus Interest Rate was 3.90% per annum, the Promotional Interest Rate would be 5.40% per annum. The Regular Interest Rate is subject to change without notice, and the most current rate is posted on our Personal Accounts Interest Rates webpage, which may be viewed at https://www.rbcroyalbank.com/rates/persacct.html. At the end of the Promotional Period, all balances will earn interest at the Regular Interest Rate only. Regular Interest Rate and Bonus Interest Rate are annualized rates, and (subject to certain exceptions) are calculated daily and paid monthly. Any Eligible eSavings Account that, prior to the payment of interest at the Bonus Interest Rate, is closed or switched to another product type which is not an RBC High Interest eSavings Account will forfeit any such interest calculated during the month in which the Eligible eSavings Account is closed or switched. Offer and interest rates are subject to change without notice. Offer may be withdrawn at any time. Conditions apply. For other defined terms and complete terms and conditions that apply to this Offer, please visit https://www.rbcroyalbank.com/investments/psi/august2024-hisa/terms.html.

legal disclaimer 9)Eligible accounts include: RBC VIP Banking, RBC Signature No Limit Banking, RBC Advantage Banking, RBC Day to Day Banking account. You must close the account and apply for the refund or switch to another account within 4 months of account opening or upgrade. Offer limited to one account opening or upgrade per customer per calendar year. Offer may be withdrawn at any time without notice.

legal disclaimer 10)For full details regarding the protections and limitations of the RBC Digital Banking Security Guarantee, including your responsibilities in ensuring the safety and security of your transactions, please see your Electronic Access Agreement and your Opens PDF in new window Client Card Agreement for personal banking clients, and the Opens PDF in new window Master Client Agreement for business clients. This guarantee is given by Royal Bank of Canada in connection with its Online and Mobile Banking services. Formerly known as the RBC Online Banking Security Guarantee.

legal disclaimer 11)An ATM operator surcharge (also called convenience fee) may be charged by other ATM operators. The convenience fee is not a Royal Bank fee. It is added directly to the amount of your cash withdrawal. All clients who use non-RBC ATMs may be charged a convenience fee regardless of the type of Account they hold.

When you use your Client Card to make a withdrawal in a currency other than Canadian dollars at an ATM outside Canada displaying the PLUS system symbol, we will convert the amounts withdrawn and any associated charges imposed by any third party for the use of the ATM to Canadian dollars when we deduct the funds from your Account. We will convert these amounts to Canadian dollars no later than the date we post the transaction to your Account at our exchange rate, which is 2.5% over a benchmark rate set by Visa International, a subsidiary of Visa Inc., and which Royal Bank of Canada pays on the date of conversion. This rate may be different from the rate in effect on the date your ATM withdrawal occurred or on the date of the transaction.

legal disclaimer 12)RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc.

Student Edition is intended for clients under the age of 22. RBC Online Banking is operated by Royal Bank of Canada.

legal disclaimer 13)The Offers program is available to clients with an RBC Royal Bank (i) debit card tied to a personal or business chequing account, and/or (ii) personal or business credit card, other than an RBC Commercial Visa or RBC US Dollar Visa card.

Eligibility criteria for an Offer: (a) is determined by RBC, (b) may vary depending on the offer, and (c) may be based on the client’s preferences and account status. Eligible clients will refer to the terms and conditions applicable to each specific Offer for more details.

legal disclaimer 14)Debit transactions made using your Virtual Visa Debit Number do not count against any monthly transaction limits applicable to your personal deposit account. Other account fees may apply. Please see the RBC Royal Bank Disclosures and Agreements related to Personal Deposit Accounts booklet or other applicable account agreement for further details. You must request a Virtual Visa Debit card.

legal disclaimer 15)When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Opens PDF in new window Value Program Terms & Conditions.

legal disclaimer 16)By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit ® associated with your Enrolled Account. Conditions apply. For complete details, please see the Opens PDF in new window Value Program Terms & Conditions.

legal disclaimer 17)To participate in this offer, you must have an RBC debit or credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC business clients will only be able to link up to two (2) business credit cards and one business debit card to a Petro-Points card. You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A linked RBC Card means an RBC Card linked to a Petro-Points Account. Your linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your linked RBC Card at Petro-Canada locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your linked RBC Card. Each time you use your linked RBC Card to purchase any grade of gasoline, or diesel, at a Petro-Canada location, you will save three cents ($0.03) per litre at the time of the transaction.

Each time you use your linked RBC Card to pay for qualifying purchases at a Petro-Canada location, you will earn a bonus of twenty percent (20%) more Petro-Points than you normally earn, in accordance with the Petro-Points terms and conditions available at www.petro-canada.ca/en/personal/terms-conditions. Petro-Points are not awarded on tobacco products, vaping products, gift cards, transit tickets and taxes on non-petroleum purchases.

legal disclaimer 18)If you have an eligible banking account and two or more qualifying, eligible RBC® products in the same geographic location (region), you may receive a partial or full rebate on your Monthly Fee. Conditions apply. For more information on the MultiProduct Rebate® visit any RBC Royal Bank branch, call 1 800 769-2511 1 800 769-2511 or view the full Disclosures and Agreements Booklet.

legal disclaimer 19)This offer only applies to new applications for an RBC ION + Visa credit card received between May 28, 2024 and November 4, 2024 (“Offer Period”) and approved by Royal Bank of Canada (“Royal Bank”), subject to the conditions below. Additional cardholders(s) (co-applicant and authorized user(s)) on the RBC ION+ Visa credit card account, as well as existing cardholders on any RBC Royal Bank personal credit card transferring to an RBC ION+ Visa credit card during the Offer Period, are not eligible for this offer.

12,000 welcome Avion points (“Welcome Points”) will appear on your monthly credit card statement within sixty (60) days after your application has been approved, provided that your RBC ION+ Visa credit card account (“Credit Card Account”) remains open and in good standing at the time the Welcome points are credited to your account, “good standing” meaning that your Credit Card Account must not be past due for more than two (2) consecutive credit card account statement periods, closed, charged off or in credit revoked status.

If you close or change your RBC ION+ Visa credit card for another type of RBC Royal Bank credit card before the Welcome Points have been credited to your account, you may lose the benefit of this offer. This offer may not be combined or used in conjunction with any other offer. Royal Bank reserves the right to cancel, modify or withdraw this offer at any time without notice, even after your application has been approved, including if we suspect that you may be manipulating or abusing it, or engaging in any suspicious or fraudulent activity, as determined by Royal Bank in its sole discretion. For complete terms and conditions that apply to the Avion Rewards Program, please visit www.avionrewards.com or call 1-800-769-2512

To get $80 worth of gift cards/certificates, you will need a total of 11,200 Avion points. Minimum redemption of 1,400 Avion points for most $10 gift cards/certificates. Some exceptions apply. Point redemption values may fluctuate. For general redemption terms, conditions and restrictions that apply to the Avion Rewards program, as well as for current point redemption values, please visit https://www.avionrewards.com/terms-and-conditions/index.html or call 1-800-769-2512 .

legal disclaimer 20)The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

legal disclaimer 21)Total of 90 days: For the purpose of this RBC New eSavings Client Bonus Interest Rate Offer and any related marketing, any reference to a period of 3 months means a period of 90 calendar days regardless of how many calendar days may fall within any given calendar 3-month period.

legal disclaimer ® / ™Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada.